Liquidation Melbourne Can Be Fun For Everyone

Table of ContentsThe Only Guide to Bankruptcy VictoriaGetting My Bankruptcy Victoria To WorkPersonal Insolvency Things To Know Before You Get ThisGetting My Bankruptcy Australia To WorkSome Of Liquidation Melbourne

As Kibler stated, a company needs to have an actually excellent factor to reorganize a great reason to exist and the rise of e-commerce has made retailers with enormous shop existences out-of-date. Second opportunities may be a cherished American suitable, but so is innovation as well as the growing discomforts that feature it.Are you staring down the barrel of proclaiming on your own bankrupt in Australia? If you are facing economic challenge after that you are not the only one. We comprehend that every person can hit difficult times from time to time. However, this is no justification for a person leading you down the path of proclaiming personal bankruptcy. Do not be drawn into getting in into a debt agreement or declaring bankruptcy.

We comprehend that everybody deals with financial pressure eventually in their lives. In Australia, also houses and companies that appear to be prospering can experience unexpected difficulty as a result of life changes, work loss, or factors that run out our control. That's why, right here at Obtain Out of Debt Today, we provide you experienced suggestions and also appointments about real repercussions of personal bankruptcy, financial obligation agreements and other financial issues - we want you to return on your feet as well as remain there with the most effective feasible end result for your future as well as all that you wish to acquire.

Some Of Bankruptcy Advice Melbourne

It is worth noting that when it comes to financial debt in Australia you are not the only one. Individual bankruptcies and also bankruptcies go to a record high in Australia, affecting three times as several Australian contrasted to twenty years earlier. There is, however, no safety in numbers when it concerns stating bankruptcy as well as bankruptcy.

Something that many Australian people are uninformed of is that in actual fact you will be noted on the Australian NPII for just lodging an application for a debt agreement - Bankruptcy. Lodging a debt contract is in fact an act of stating on your own insolvent. This is an official act of bankruptcy in the eyes of Australian legislation also if your financial obligation collection agencies do decline it.

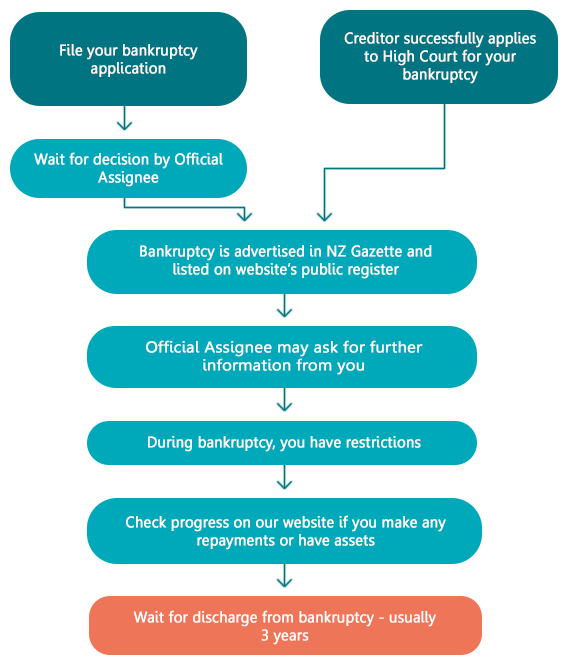

During and after your insolvency in Australia, you have particular responsibilities and face particular limitations. Any lenders that are desiring to acquire a copy of your debt record can request this information from a credit report coverage firm. As soon as you are declared insolvent safeguarded financial institutions, that hold security over your property, will likely be entitled to seize the building and also market it.

The Only Guide to Bankruptcy Melbourne

a residence or car) As soon as stated insolvent you should educate the trustee promptly if you become the recipient of a deceased estate If any one of your lenders hold valid safety over any property and they take activity to recover it, you have to aid You have to surrender your key to the trustee if you are asked to do so You will continue to be responsible for financial debts incurred after the date of company website your personal bankruptcy You will will not have the ability to function as a supervisor or supervisor of a firm without the courts approval As you can see getting in into insolvency can have lengthy long-term unfavorable effects on your life.

Becoming part of insolvency can leave your life in tatters, shedding your residence and also possessions as well as leaving you with nothing. Avoid this end result by talking with a financial obligation counsellor today concerning taking a different rout. Insolvency needs to be effectively thought about as well as intended, you must not ever before enter insolvency on a whim as it can take on you that see page you might not also understand. File for Bankruptcy.

We offer you the capability to pay your debt off at a lowered price as well as with decreased interest. We know what creditors are looking for and are able to negotiate with them to offer you the ideal possibility to pay off your debts.

A Biased View of Bankruptcy Australia

What is the distinction between default as well as bankruptcy? Skipping on a loan implies that you have actually broken the promissory or cardholder address arrangement with the lender to make payments on time.

A Biased View of Bankruptcy

For example, if you fail on a vehicle car loan, the lender will certainly frequently try to repossess the automobile. Unsafe debt, like charge card financial debt, has no collateral; in these situations, it's harder for a collection company to recover the financial debt, but the firm might still take you to court as well as effort to place a lien on your home or garnish your incomes.

The court will certainly designate a trustee who might liquidate or offer a few of your ownerships to pay your lenders. While a lot of your financial obligation will be canceled, you might select to pay some lenders in order to keep a vehicle or home on which the creditor has a lien, says Ross (Bankruptcy Melbourne).

If you operate in an industry where companies check your debt as component of the employing process, it might be much more difficult to obtain a brand-new job or be promoted after insolvency. Jay Fleischman of Money Wise Legislation claims that if you have bank card, they will certainly often be shut as quickly as you apply for insolvency.